So, you are finishing off the financial year and hopefully have the privilege of paying taxes. We all know that it is the rare air of the successful organisation with profit and growth that gets to share in this incredible tradition of paying some of that success forward to your enabling environment. There are often mixed emotions regarding the quantum and the perceived value received in exchange, but let’s leave that to the economists and politicians.

It presents an opportunity of which only an astute few take sufficient advantage. A portion of this tax base is set aside for education, economic empowerment of the poor and vulnerable, and community development. The DTI and SARS offer only guidelines for this portion but entrust its execution to the economic and social sectors.

I am referring, of course, to BB-BEE and CSI (Sec 18A) legislation. What makes this portion of your taxes so significant is that within the confines of the guidelines, you get to exert influence over how and where it is allocated. This is no insignificant thing. Done correctly, you could leverage these portions of taxes for:

- Talent and Skills Development

- Stakeholder Management and Development

- Social Upliftment and Brand Awareness

POPUP Upliftment NPC has been leveraging these tax mechanisms since 2005 to create value for our partners and cities. Done well, it lets your taxes work for you while doing good for others, a real win-win-win, which, to paraphrase Eli Goldratt, is the only kind of sustainable outcome.

Talent and Skills Development

As part of your BEE scorecard under skills, you could fund short skills programmes and learnerships. Both mechanisms could be employed to nurture young talent. With POPUP, we conduct training, management, recruitment, and hosting if required. Over time, we could craft your talent pools for future recruitment to ensure culture and character fit with your organisation: no more dud appointments and 1000 cvs.

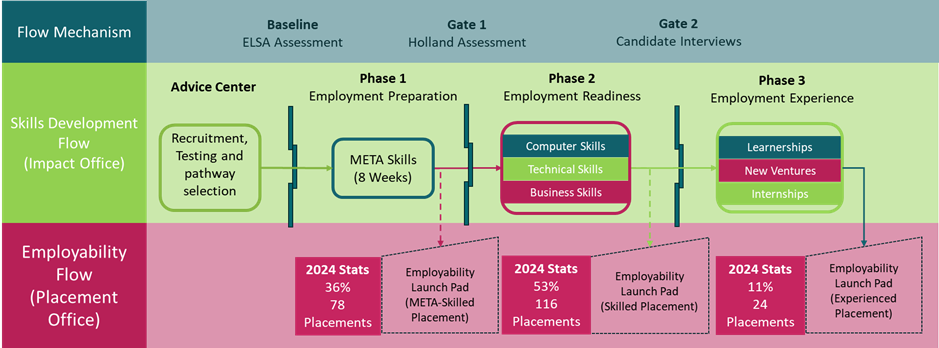

Our process below gives an idea of our multifaceted approach to talent development from underserved social groups, which creates win-win-win outcomes from your taxes.

Figure 1 – POPUP 3 Phase Learner Journey

Stakeholder Management and Development

Many industries are deeply connected to the local communities in which they operate. These become long-term stakeholders who are acutely aware of the promises you have made and which ones you delivered on. POPUP’s unique approach offers the opportunity to collaborate with your local community for local talent pipeline development. This brings better skills and competence to your recruitment basins and increases economic flourishing in your stakeholder communities in tangible ways. For the few brave souls willing to take a long-term view, this could develop significant strategic assets that will radically reposition your business and its stakeholder relationships. Pro-active approaches are the only true win-win-win outcomes.

Social Upliftment and Brand Awareness

Speaking of proactive approaches. Gone are the days of hit-and-run social upliftment projects. Sustainability requires us to posture for systems change, not just first aid. The winning brands are willing to invest in changing systems to change the outcomes. POPUP celebrated 25 years of impact in 2024. We have intimate knowledge of what it takes to confront and ultimately win out over the giants we face in the way that system inertia protects the status quo. When you want to go far, go together, but choose a partner that understands the journey.

The Journey of 1000 Miles

It starts with the first step, perhaps a change in perspective. The rise in trust-based philanthropy suggests that funders engage with impact organisations in a way that trusts them to deliver what they are best at. Outsourcing decisions are always challenging, but if it is not a core function someone else will do it better, cheaper and with a better ROI. The same is true for social impact.

If you are ready to explore better ways to achieve win-win-win outcomes from taxes, perhaps it’s time to connect with us – your partner in delivering exceptional value.